First Look at November 2022 Mortgage Data

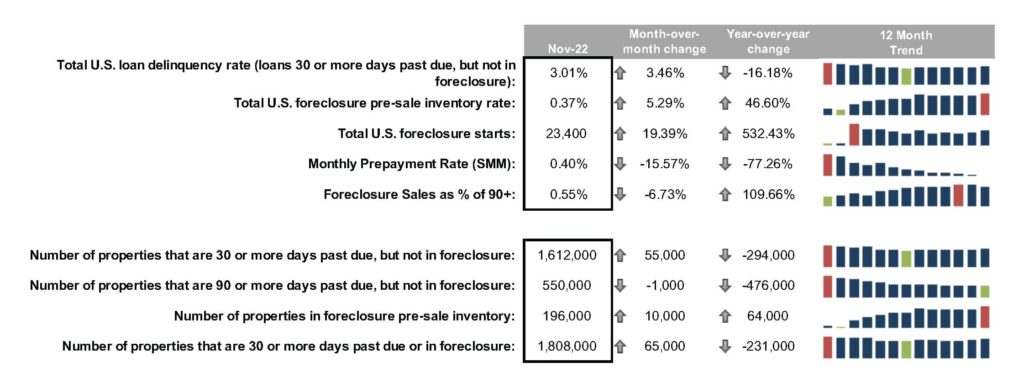

- Prepayment activity in November dropped 15.6% to a single month mortality (SMM) rate of 0.40% – once again marking the lowest rate on record since before 2000 when ICE started reporting the metric

- The national delinquency rate rose another 3.5% in November to 3.01%, up 10 basis points since October, driven by a 31K (+3.9%) increase in 30-day delinquencies and a 25K (+11%) rise in 60-day delinquencies

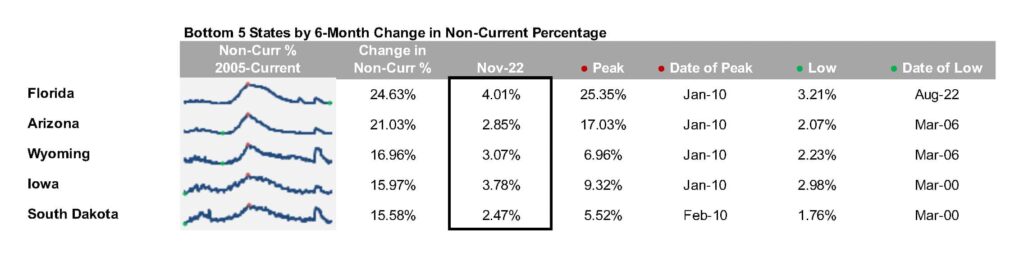

- The delinquency rate in Florida rose another 18 basis points in the month to 3.60% as the impact of Hurricane Ian on homeowners’ ability to make mortgage payments continues

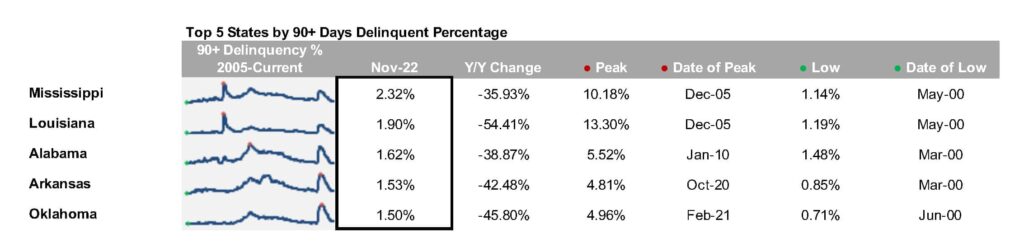

- Improvement among seriously past-due loans continues to stagnate, with the population of 90-day delinquencies ticking down -0.2% from the month prior

- Foreclosure starts rose again (+19%) on the heels of October’s increase, but the month’s 23.4K starts are still below the recent high seen in June 2022 and remain 30% below pre-pandemic levels

- Foreclosure was started on 4.3% of serious delinquencies in November, up 7 basis points from October but still 44% less than the rate seen in the years leading up to the pandemic

- Active foreclosure inventory rose 5.3%, though 2022 volumes remain subdued after the record lows of 2021 due to widespread moratoriums and forbearance protections

JACKSONVILLE, Fla. – Dec. 22, 2022 – ICE reports the following “first look” at November 2022 month-end mortgage performance statistics derived from its loan-level database representing the majority of the national mortgage market.

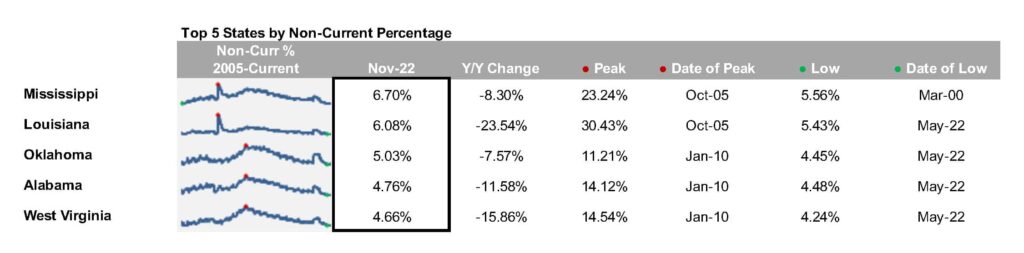

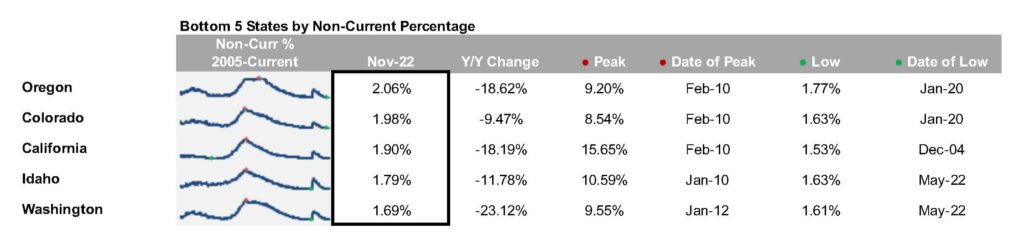

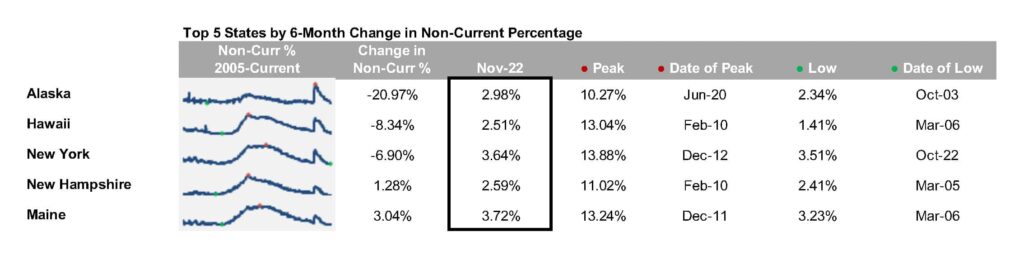

*Non-current totals combine foreclosures and delinquencies as a percent of active loans in that state.

Notes:

- Totals are extrapolated based on ICE’s loan-level database of mortgage assets.

- All whole numbers are rounded to the nearest thousand, except foreclosure starts, which are rounded to the nearest hundred.

Please note that ICE does not release an edition of the Mortgage Monitor report over the holidays and will return to its normal publishing schedule the first week of February 2023.

For more information about gaining access to ICE’s loan-level database, please send an email to Mortgage.Monitor@bkfs.com.

About Black Knight

Black Knight, Inc. (NYSE:BKI) is an award-winning software, data and analytics company that drives innovation in the mortgage lending and servicing and real estate industries, as well as the capital and secondary markets. Businesses leverage our robust, integrated solutions across the entire homeownership life cycle to help retain existing customers, gain new customers, mitigate risk and operate more effectively.

Our clients rely on our proven, comprehensive, scalable products and our unwavering commitment to delivering superior client support to achieve their strategic goals and better serving their customers. For more information on Black Knight, please visit www.blackknightinc.com.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500 company that designs, builds and operates digital networks that connect people to opportunity. We provide financial technology and data services across major asset classes helping our customers access mission-critical workflow tools that increase transparency and efficiency. ICE’s futures, equity, and options exchanges – including the New York Stock Exchange – and clearing houses help people invest, raise capital and manage risk. We offer some of the world’s largest markets to trade and clear energy and environmental products. Our fixed income, data services and execution capabilities provide information, analytics and platforms that help our customers streamline processes and capitalize on opportunities. At ICE Mortgage Technology, we are transforming U.S. housing finance, from initial consumer engagement through loan production, closing, registration and the long-term servicing relationship. Together, ICE transforms, streamlines and automates industries to connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located here. Key Information Documents for certain products covered by the EU Packaged Retail and Insurance-based Investment Products Regulation can be accessed on the relevant exchange website under the heading “Key Information Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 -- Statements in this press release regarding ICE's business that are not historical facts are "forward-looking statements" that involve risks and uncertainties. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see ICE's Securities and Exchange Commission (SEC) filings, including, but not limited to, the risk factors in ICE's Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on February 8, 2024.

Media Contacts

Mitch Cohen

704.890.8158

mitch.cohen@ice.com

Katia Gonzalez

678.981.3882

katia.gonzalez@ice.com